Explore the Benefits of Using a Prepaid Credit Card

Introduction to Prepaid Cards

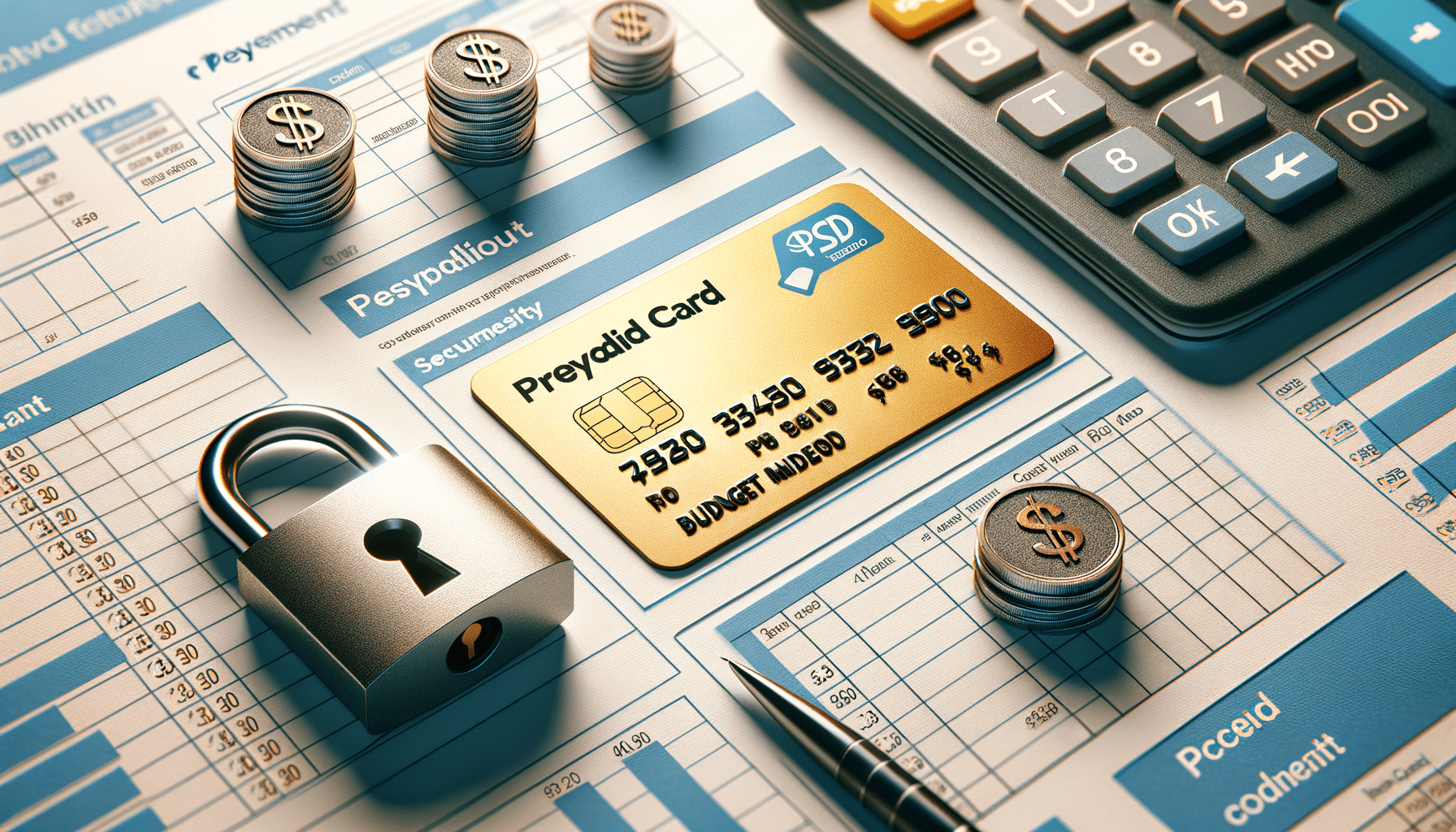

In today’s fast-paced world, managing finances efficiently is more crucial than ever. One tool that has gained popularity for its convenience and control is the prepaid card. Unlike traditional credit or debit cards, a prepaid card is not linked to a bank account. Instead, it allows users to load a specific amount of money onto the card, which can then be used for purchases. This feature makes it an attractive option for those looking to control their spending, avoid debt, and maintain financial discipline.

Prepaid cards are widely accepted and can be used for online shopping, travel, and everyday expenses. They offer the flexibility of a credit card without the risk of overspending, as users can only spend what they have loaded onto the card. This makes prepaid cards a practical choice for budget-conscious individuals and those who prefer not to use traditional banking services.

Secure Payments with Prepaid Cards

Security is a major concern for anyone making financial transactions, especially online. Prepaid cards offer a layer of security that can be appealing to many users. Since they are not directly linked to a bank account, the risk of unauthorized access to personal banking information is minimized. In the event of loss or theft, the potential financial damage is limited to the balance on the card.

Additionally, many prepaid cards come with features like fraud protection and the ability to lock or cancel the card if it is lost. This provides peace of mind for users who want to ensure their financial information remains secure. For online purchases, using a prepaid card can also reduce the risk of fraud, as users can limit the amount available for spending, thereby controlling potential exposure to fraudulent transactions.

Budget Management with Prepaid Cards

Effective budget management is essential for financial well-being, and prepaid cards can be a valuable tool in achieving this. By loading a predetermined amount of money onto the card, users can set clear limits on their spending. This helps prevent overspending and encourages more mindful purchasing decisions.

Prepaid cards can also be used to allocate funds for specific purposes, such as groceries, entertainment, or travel. This compartmentalization of expenses can aid in maintaining a balanced budget and ensuring that funds are available for essential needs. Additionally, many prepaid cards offer online account management tools, allowing users to track their spending and adjust their budgets as needed.

Prepaid Cards for Travel

Traveling with a prepaid card can offer numerous advantages, particularly for those concerned about security and budgeting. Prepaid cards are widely accepted internationally, making them a convenient option for travelers. They eliminate the need to carry large amounts of cash, reducing the risk of loss or theft.

Moreover, using a prepaid card while traveling allows for better control over foreign exchange fees. Travelers can load the card with the desired currency before departure, locking in exchange rates and avoiding fluctuating rates during their trip. This can lead to significant savings and a more predictable travel budget.

Conclusion: Embracing Prepaid Cards for Financial Health

In conclusion, prepaid cards offer a flexible and secure way to manage finances. They provide an excellent solution for those seeking to control their spending, enhance security, and simplify travel expenses. By using prepaid cards, individuals can enjoy the benefits of modern financial tools without the complexities and risks associated with traditional banking methods.

Whether you’re looking to improve your budgeting habits, make secure online purchases, or travel with ease, a prepaid card can be a valuable addition to your financial toolkit. As more people recognize the advantages of prepaid cards, they continue to grow in popularity as a practical choice for managing everyday finances.