Find Opportunities in Tax-Free Investments in the UAE

Introduction to UAE Investment Landscape

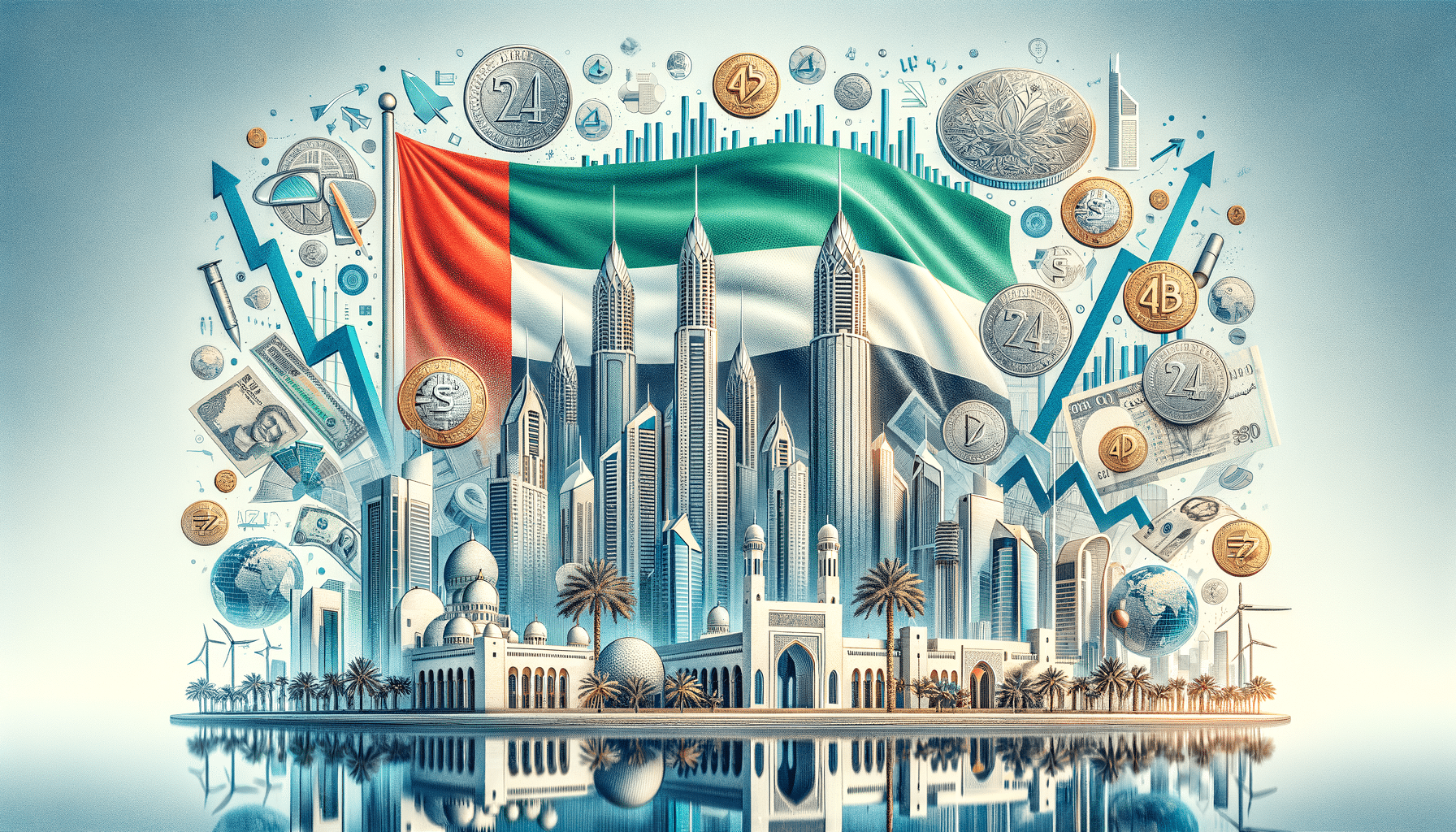

The United Arab Emirates (UAE) has emerged as a lucrative destination for investors worldwide, thanks to its tax-free environment and robust economic framework. The nation’s strategic location as a gateway between the East and West, coupled with a stable political climate, makes it an attractive hub for international business. Investors are particularly drawn to the UAE’s diverse sectors, ranging from real estate to technology startups, all offering substantial growth potential.

In recent years, the UAE government has introduced various initiatives to enhance the investment climate, including relaxed visa regulations and incentives for foreign businesses. These measures are designed to attract more expatriates and global investors, further bolstering the economy. The tax-free returns on investments are a significant draw for expats looking to maximize their financial gains while residing in the UAE.

Overall, the UAE’s investment landscape offers a unique combination of opportunities and benefits, making it a highly regarded destination for investors seeking to diversify their portfolios and capitalize on tax-free returns.

Navigating Tax-Free Returns in the UAE

One of the most appealing aspects of investing in the UAE is the potential for tax-free returns. Unlike many other countries, the UAE does not impose personal income tax, capital gains tax, or inheritance tax, allowing investors to retain a larger portion of their profits. This tax-friendly environment is particularly advantageous for expatriates and international investors who are keen on maximizing their investment returns.

For those considering real estate investments, the UAE offers a variety of options, from luxury residential properties to commercial spaces. The real estate market has shown resilience and growth, supported by strong demand and government initiatives to attract foreign investment. Additionally, investing in startups and technology sectors provides opportunities for high returns, given the UAE’s focus on innovation and digital transformation.

While the tax-free status is a significant advantage, investors should also be aware of potential fees and charges associated with transactions and property ownership. It’s essential to conduct thorough research and seek professional advice to navigate the complexities of the UAE’s investment landscape effectively.

Expat Finance: Managing Wealth in the UAE

For expatriates residing in the UAE, managing finances effectively is crucial to making the most of the tax-free environment. With a significant portion of the population being expats, the UAE has developed a range of financial services tailored to their needs. From banking and investment products to insurance and retirement planning, expats have access to a comprehensive suite of financial solutions.

One of the key considerations for expats is currency exchange and transfer services. With many expats sending money back to their home countries, finding cost-effective solutions for currency exchange is essential. Additionally, understanding the local banking system and choosing the right bank can help expats manage their finances more efficiently.

Expats should also consider long-term financial planning, including retirement savings and investment portfolios. The absence of income tax provides an opportunity to save and invest more of one’s earnings, making it possible to build substantial wealth over time. Seeking advice from financial advisors who understand the unique challenges and opportunities faced by expats in the UAE can be invaluable in achieving financial goals.

Investment Opportunities in UAE’s Real Estate Sector

The UAE’s real estate sector continues to be a major attraction for investors, offering a range of opportunities from residential to commercial properties. The country’s rapid urbanization and infrastructure development have fueled demand for properties, making it a thriving market for both local and international investors.

Investors can explore various segments within the real estate market, including luxury apartments, villas, and commercial spaces. The government’s initiatives to boost foreign investment in real estate, such as allowing 100% foreign ownership in certain areas, have further enhanced the sector’s appeal.

Despite the challenges posed by global economic fluctuations, the UAE’s real estate market has shown resilience, supported by a growing population and a steady influx of expatriates. As a result, investors can expect to find opportunities for both capital appreciation and rental income, contributing to their overall investment portfolio.

Exploring Startup Investments in the UAE

The UAE has positioned itself as a hub for innovation and entrepreneurship, making it an attractive destination for startup investments. With a focus on technology and digital transformation, the country is home to a growing number of startups across various sectors, including fintech, e-commerce, and health tech.

Investors looking to capitalize on the UAE’s dynamic startup ecosystem can benefit from government support and initiatives aimed at fostering innovation. The establishment of free zones and incubators provides startups with the resources and environment needed to thrive, offering investors opportunities for high returns.

While investing in startups carries inherent risks, the potential for significant rewards is also high. By conducting thorough due diligence and leveraging local networks, investors can identify promising startups and contribute to the UAE’s burgeoning innovation landscape.